Impact investing made easy

Why choose between making money and making a difference?

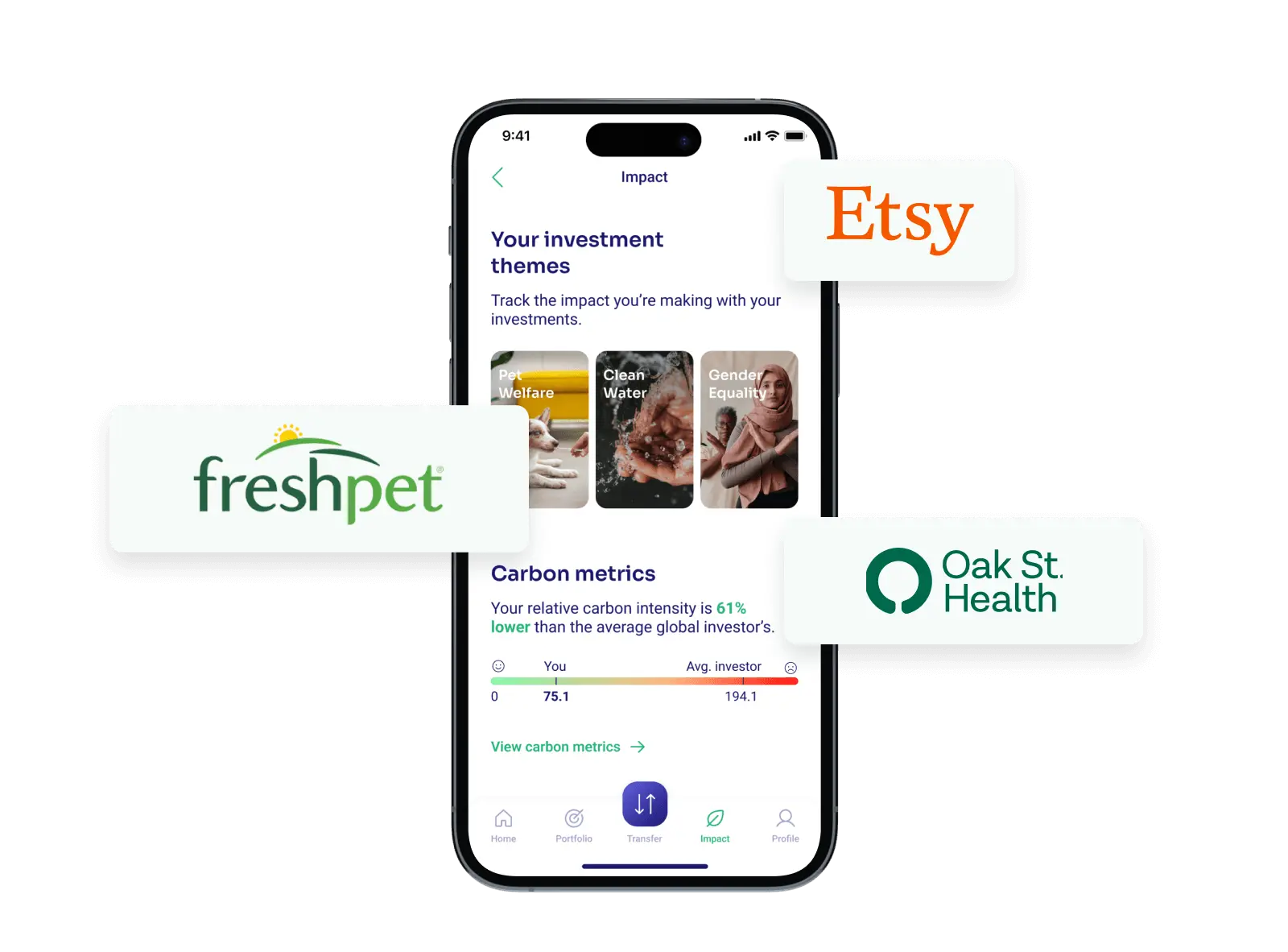

Put your money where your heart is

Align your investments with your values, and we’ll show you how your money is shaping the world.

Beginner friendly

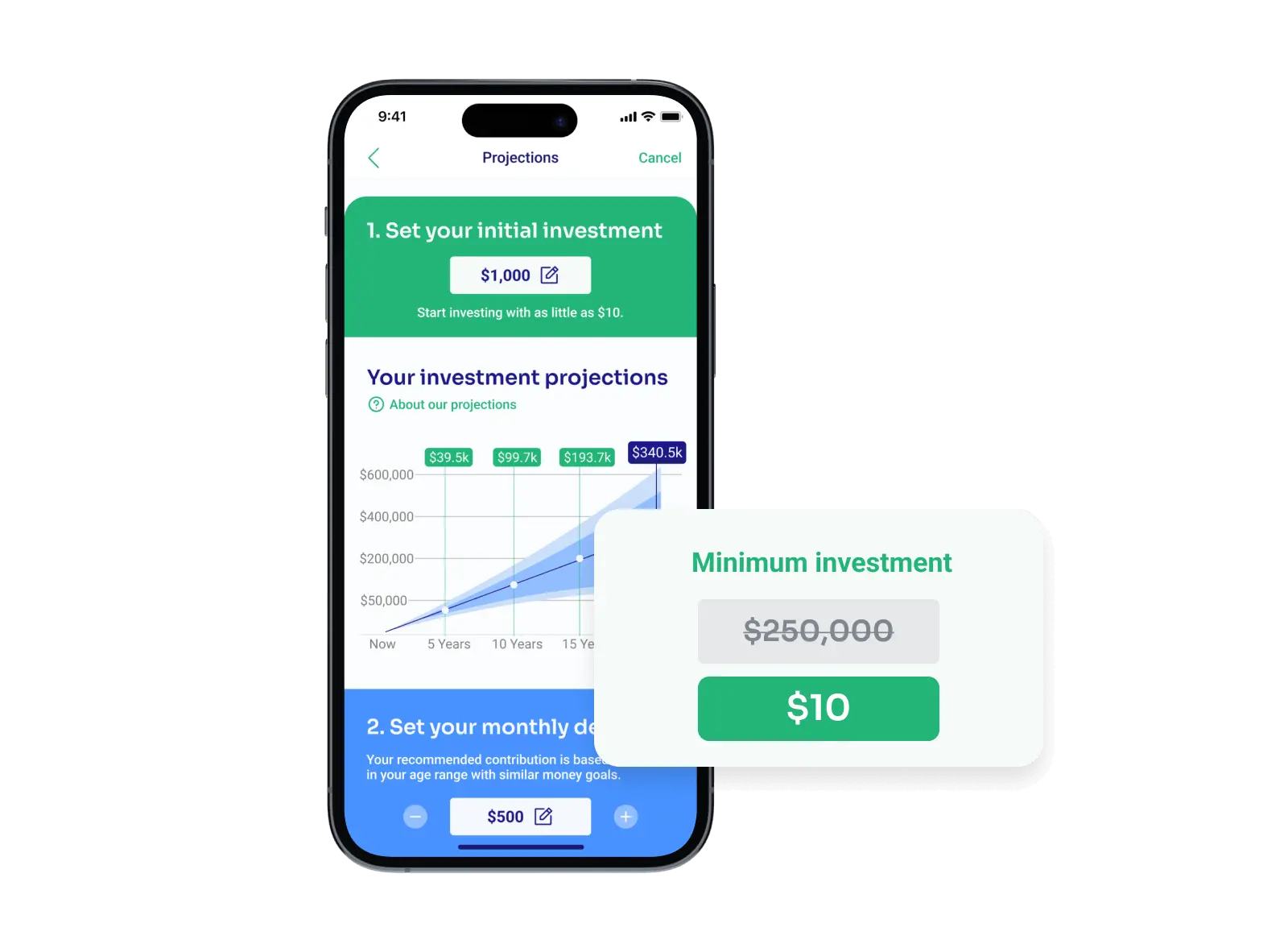

Investing shouldn’t be scary! To make things easy, we’ve automated investing. Get started in less than 5 minutes by answering a few questions. No more excuses, start investing today.

No greenwashing

Most investing options that market themselves as green aren’t very different from traditional investing. We go beyond green labels for a genuinely sustainable portfolio. Start investing with companies that share your values while excluding those that don’t.

Impact investing made for everyone

FLIT Invest provides impact investing solutions typically reserved for the wealthy at a fraction of the cost. We want everyone to harness the power of their money to drive change without large account minimums.

Here's what our community is saying...

We're proudly working with

Safety & security

Is it safe to invest with a startup like FLIT Invest? Yes! You own all of the investments in your account and we provide ourselves on the following.

FINRA & SIPC insured by Apex Clearing

Your account is held by Apex Clearing Corporation and is SIPC-protected up to $500,000 including $250,000 in cash. Apex also works with Robinhood and Ally.

SEC Registered Investment Advisor

We are a Registered Investment Advisor with the SEC. This means that we have a fiduciary duty to act in your best interest.

Bank-level security & 256-bit encryption

We work with Plaid, also used by Venmo, Ally and Mint. All stored data is protected with 256-bit encryption, the same level of security as at large financial institutions.

Your questions answered

FLIT Invest is an automated impact investing app designed to grow your wealth while making an impact. We’re on a mission to help people achieve financial security and change the world at the same time. Throughout the process, we strive to promote financial literacy (hence the name FLIT), a core value of our team and the cornerstone of our approach to making impact investing easy. Learn more about us here.

Your money has the power to do well by doing good. Impact investing is a strategy that targets positive, measurable social and environmental impact alongside financial returns. You can directly fund solutions that promote a more sustainable future by redirecting your investments to companies that align with your values while excluding those that don’t. Learn more.

While there is no universal definition, sustainable investing (or responsible investing) refers to an investment philosophy that considers environmental, social, and governance (ESG) criteria and can be grouped into the following two strategies:

- Socially Responsible Investing (SRI): Avoid harmful investments that do not align with your values (fossil fuels, for-profit prisons, civilian firearms, military weapons, etc.)

- ESG Investing: Integrating Environmental, Social, and Governance (ESG) factors into traditional investment processes to improve a portfolio’s long-term risk/return profile.

- Impact Investing: This investment approach goes beyond sustainable investing as the primary intent of this strategy is to generate measurable positive environmental and social impact. Learn more about how we measure impact.

All FLIT Invest accounts are in the custody of Apex Clearing Corporation and SIPC-protected up to $500,000, including $250,000 in cash balances. SIPC protects against losses resulting from the insolvency of a broker-dealer. The $500,000 amount is standard for investment companies.

In addition to SIPC protection, FLIT Invest monitors unusual activity across all accounts and systems to ensure the safety of your funds, data, and personal information. We encrypt all stored data with 256-bit encryption, the same level of security as at large financial institutions. We also use two-factor authentication (2FA) to secure all accounts further and validate our security posture with third-party penetration testing.

Historically, some of the best times to start investing have been periods of down markets, also known as bear markets. Why? Because currently, stocks are on sale, meaning you are getting a lower price when purchasing them.

While the average bear market lasts about 1.1 year, the average bull market (when stocks are going up) lasts about 3.9 years. Since it’s impossible to predict when the market will bottom, buying things on sale has proven to be a successful investment strategy.