When you invest in companies that claim to do good, you want to see the evidence, right? We believe this too. Our team of dedicated analysts conducts hours of research to bring you the impact of your investments—the metrics and figures of your real-term impact by investing in our portfolios. FLIT Invest provides impact tracking for carbon metrics, thematic metrics (social and environmental), and UN SDG mapping – but what does it all mean? This article will go into more depth on what our carbon metrics capture and what those awesome numbers in your app mean for the world.

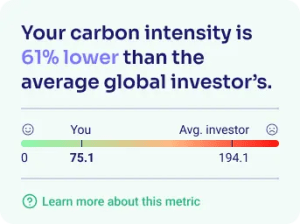

Relative Carbon Intensity

What does relative carbon intensity mean?

Relative carbon intensity is your total investment portfolio’s exposure to carbon-intensive companies. Carbon intensity is the asset-weighted average carbon intensity of your holdings in the portfolio. The lower, the better. This is one of the primary metrics looked at by climate-conscious investors. At FLIT Invest, your carbon performance is benchmarked and compared to the average global investor.

Due to the limited availability of renewable energy and technologies, most companies have carbon emissions they cannot avoid. Large companies tend to use more energy, but they could also be more energy efficient. To compare companies of different sizes and sectors, the Task Force on Climate-Related Financial Disclosures (TCFD) recommends using this metric which shows the emissions relative to the size of the companies, where the revenue of the company expresses size. This makes companies across multiple sectors and industries comparable, but the data tends to favor companies with higher pricing levels relative to their peers.

How is relative carbon intensity calculated?

FLIT sources the data from As You Know, the impact data arm of the leading shareholder advocacy non-profit, As You Sow. Calculation of this metric is simple and based on standards defined by the TCFD. Carbon Intensity is computed for each holding as Total Emissions (metric tons of CO2) / Revenue (Mil USD). Carbon Emissions are reported in line with the Greenhouse Gas Protocol standards. Emissions used for the calculation include Scope 1 (Direct) and Scope 2 (Indirect) greenhouse gas (GHG) emissions in millions of metric tons.

Scope 1 emissions are direct GHG emissions from sources owned or controlled by a company, such as burning fossil fuels, air-conditioning leakage, or farm animals.

Scope 2 emissions are indirect GHG emissions generated by the production of energy used by the company, which are also often referred to as purchased energy.

Scope 3 carbon emissions encompass all other indirect emissions that are the consequence of the company’s activities but occur from sources not owned or controlled by the institution, including transportation costs and the use of sold products.

Scope 1 and 2 disclosures are robust and available. Scope 3 is the least robust and reliable data, most companies do not disclose it today, and therefore any dataset would include significant estimations. Hence the official TCFD calculations only recommend using Scope 1+2 emissions until reliable data is available. The SEC’s goal is to require all companies to disclose Scope 3 emissions will help data quality and is expected to drive climate action.

Your carbon performance is compared to the average global investor. The average global investor is defined as an investor who holds the MSCI World Index, which includes the largest companies in the world that are usually part of a well-diversified investment portfolio.

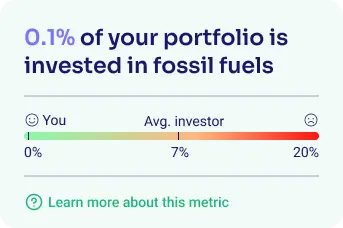

Fossil Fuel Involvement

What does fossil fuel involvement mean?

Fossil Fuel Involvement is the percentage of the portfolio’s assets that are directly involved in fossil fuels – coal, oil, and gas. Investors who want to divest from fossil fuels can target funds with 0% exposure to fossil fuels. Your carbon performance is benchmarked and compared to the average global investor.

How is fossil fuel involvement calculated?

FLIT sources the data from leading shareholder advocacy non-profit, As You Sow. They utilize the research of multiple research non-profit organizations, including the Carbon Underground 200, Macroclimate 30, and Morningstar, amongst others.

Companies are considered involved in fossil fuels if they derive their revenues from the following activities: thermal coal extraction, thermal coal power generation, oil and gas production, oil and gas power generation, and oil and gas products & services. All companies go through the following fossil fuel screens:

OIL & GAS: companies assigned to the following Morningstar Oil and Gas industries: Drilling, Exploration & Production, Integrated, Midstream, Refining & Marketing, and Equipment & Services; upstream and midstream companies from the Global Oil/Gas Exit List; and the top 100 oil/gas reserve holders from the Carbon Underground 200.

COAL: companies assigned to the Morningstar thermal coal or cooking coal industries, all companies on the Global Coal Exit List with coal mining operations, and the top 100 coal reserve holders from the Carbon Underground 200. The Macroclimate 30 is an exclusion list of the 30 largest public-company owners of coal-fired power plants in Developed Markets, China, and India. Macroclimate compiled the list of 30 companies using open-source data on coal-fired power plants worldwide.

UTILITIES: companies assigned to the following Morningstar Utilities industries: Regulated Electric, Regulated Gas, Independent Power Producers, and Diversified, as well as all companies on the Global Coal Exit List with coal power operations. We remove companies in these categories engaged in 100 percent renewable operations, pure transmission, or otherwise that doesn’t burn or transport fossil fuels.

So that’s the carbon metrics explained. Stay tuned for the rest of the metrics series!