Rainforest Action Network (RAN) has released its latest report and spared no sins. Wall Street’s Dirtiest Secret reveals how fossil fuel expansion depends on big bank finance. The report demonstrates the significant extent to which the top 60 banks in the world have funded the climate crisis by helping energy companies expand their fossil fuels exploitation, despite years of commitments and ‘positive actions taken.’

What is Wall Street's dirtiest secret?

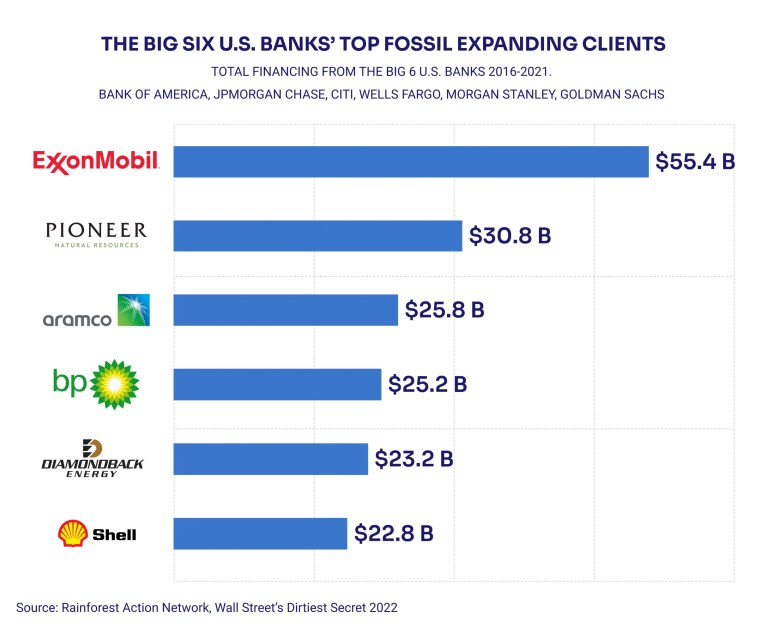

Rainforest Action Network has delved into the funding records of the largest banking institutions and aired their dirty laundry. Once again, the US Big Six (Bank of America, JP Morgan, Chase, Citi, Wells Fargo, Morgan Stanley, and Goldman Sachs) have provided 33% of the funding needed for fossil fuel expansion to the top 100 expanders. Total financing was calculated to be around $445 billion, going to companies like Exxon Mobil, BP, and Shell. More broadly, just 60 banks, mainly in the Global North, supply more than $1.3 trillion to energy companies to expand fossil fuels between 2016 and 2021.

Rainforest Action Network defines fossil fuel expansion as funding for “exploration or appraisal of new fossil fuel reserves,[…] field evaluation and resource development,[…] and new establishment of coal mines”. Fossil fuel expansion is fundamentally problematic, not only because of the footprint left by efforts to explore and exploit natural reserves but also because the depletion of resources that have yet to be exploited.

As of now, potential emissions from oil, gas, and coal reserves in already developed fields will take the world past the global 1.5C temperature increase limit to prevent worse environmental catastrophes in the future. Thus, ending the expansion of fossil fuels is necessary for limiting climate change, and even then, more is needed. Fatih Birol, Executive Director of the International Energy Agency, aptly stated, “If governments are serious about the climate crisis, there can be no new investments in oil, gas, and coal from now.”

Is Wall Street just making empty promises?

Financial institutions entered the race to zero emissions well aware of the snail speed they intended to take and how vague policies and practices would help to avoid scrutiny. These major institutions are funding the climate crisis. Despite signing on to the Net Zero Banking Alliance in 2021, the Big Six have continuously supplied capital for companies to expand fossil fuels. They pledged to achieve net zero emissions by 2050, report more transparent emissions data, and establish better targets to transition to a low-carbon future. Still, they have not done enough to bring the efforts for a cleaner, greener future to fruition.

In fact, according to RAN, recent Congressional investigations found that 10 of the biggest oil and gas companies, clients of the engaged banks, have been systematically underreporting their emissions. These companies still received $306 billion from 60 banks with Net Zero Alliance membership. The hypocrisy of 2021, found in RAN’s co-authored Banking on Climate Chaos report 2022, continues. You can read our synthesis of the report at The Dirty Dozen – Banking on Climate Chaos.

The problem is centralized enough to simplify the solutions. According to the Global Oil & Gas Exit List, upstream oil and gas expansion is remarkably concentrated: the top 20 expanding companies are responsible for more than half of the resources under development and exploration for new reserves. RAN’s findings indicate that between 2016 and 2021, the Big Six provided $222 billion in financing to the top 30 global fracking companies.

How do big banks impact human rights?

Another dimension of the problem is the locality of the direct damage that fossil fuel expansion causes. According to Rainforest Action Network, low-income people of color and Indigenous communities are most likely to feel the negative impacts of fossil expansion, just as they are likely to experience climate impacts sooner and with greater intensity. Examples range from Pakistan’s floods, killing over 1,000 people this summer, to Puerto Rico’s nationwide hurricane-caused blackouts.

However, even if those on the frontlines of the disasters are mainly populations contributing the least to climate change, fossil fuel expanders act even within the same borders of the banks that finance them. The Gulf Coast has endured pollution from the oil and gas industries in the United States for decades. For example, more than 16 liquified natural gas (LNG) facilities have been installed along the Mississippi River, between Baton Rouge and New Orleans, in Louisiana. The corridor between the cities is known as the ‘Cancer Alley’ due to the severe impact these polluting chemical plants cause on its inhabitants.

What environmental action should big banks take?

Ultimately, RAN recommends that government and civil society pressure banks develop a comprehensive framework for stopping fossil fuel expansion financing and ensuring local communities’ rights in the vicinities of already polluting development projects. Among other demands, banks must:

- Immediately exclude financing for any project that involves fossil fuel expansion.

- Develop and publish time-bound plans to cease finance for current clients expanding fossil fuels.

- Develop and publish a credible and time-bound escalation process for clients that refuse to publish or comply with fossil phase-out plans, up to and including withdrawing financing from such companies.

What can individuals do about fossil fuels finance?

You hold power if you earn, spend, or save money. You can do multiple things to cut ties with fossil fuels on an individual level (and contribute on a systemic level too). Some quickfire examples include:

- Change your bank: if you hold money with the US Big 6 (Bank of America, JP Morgan Chase, Citi, Wells Fargo, Morgan Stanley, and Goldman Sachs), consider changing where you hold your money.

- Check your investments: are you investing in companies contributing to fossil fuel expansion? Check your investments using As You Sow’s Fossil Free Funds tracker to see.

- Divest then invest: divest from fossil fuels and invest in renewables. At FLIT Invest, the fossil fuel industry is one of our industry exclusions. You can also invest in environmental themes such as Green Energy and Climate Solutions.

Let’s leave fossil fuel finance in 2022. The transition to renewables needs to accelerate, and you can help. Join the community of changemakers, and download our app today!

Footnote 1: Content is for informational and educational purposes only. Any views, strategies or products discussed may not be appropriate for all individuals and are subject to risks. Investors may get back less than they invested, and past performance is not a reliable indicator of future results. The information contained herein should not be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product. Investors should carefully consider the investment objectives and risks as well as charges and expenses of a mutual fund or ETF before investing.