What is a rainy-day fund?

A rainy-day fund, also known as an emergency fund, is a set amount of savings you put away to rely on in case of unexpected expenses or more difficult times like losing your job. The goal of a rainy-day fund is to provide you with financial stability so you can be prepared for curveballs life may throw at you. How much you need to save for your rainy-day fund depends on your financial situation, but as a rule of thumb, it should be 2-6 months of your monthly expenses.

Setting up your rainy-day fund is the first step in taking control of your finances, which is for a good reason. Nothing is more important than to be prepared for unexpected expenses that could otherwise force you into debt.

Why should it be a priority to save for a rainy-day fund?

The importance of having a rainy-day fund cannot be stressed enough. It is the first step towards your financial health. Unfortunately, many people live without emergency savings. When things go wrong, they are forced to increase their credit card debt or take out personal loans, which in some cases takes years to pay back. It is tough to bounce back in these situations and start again because the interest on these emergency loans is typically really high and can even increase your financial difficulties. You can also run into the issue of damaging your credit score, which can take years to build back up. Even just a few months of planning ahead can help you avoid these situations.

How to start saving for a rainy-day fund in 4 easy steps

1. Check how much you spend each month

There is no need to spend hours coming up with an emergency plan, but it’s an excellent exercise to put together a list of your monthly expenses quickly. Start with the biggest items like your mortgage payment or rent and work your way through your spending, including recurring items like your phone bill, subscriptions (Netflix, Hulu, Disney+), then average spend on food. If you know you expect some bigger expenses during the year (like plane tickets to visit your parents) which you feel are also essential, you can go ahead and add those to your expenses.

2. Decide how much you want to save for your rainy day-fund

Think about some important questions, like

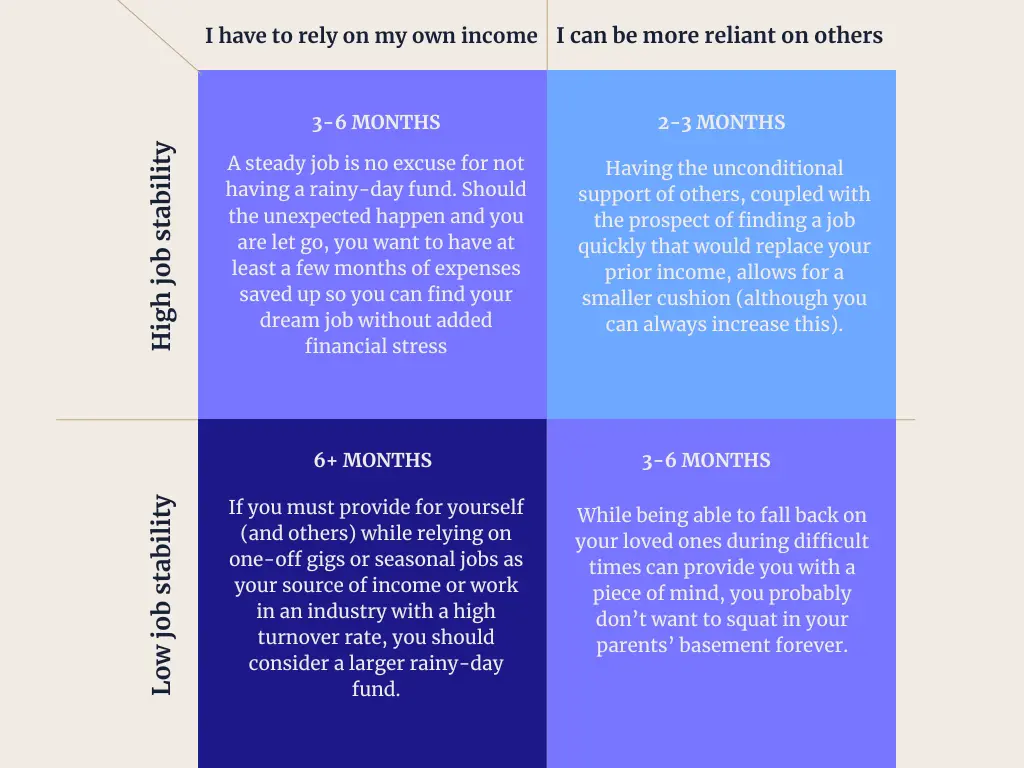

- How stable is your job and how quickly could you get a new one?

- Are there people in your life to rely on financially?

If you feel secure in your job and can be reliant on others (for example, you can move back with your parents if faced with an emergency), a smaller fund of 2-3 months of expenses may be enough for you. Think about how much savings you would need to feel more comfortable personally. Another way to think about this is to come up with a few unexpected expenses and see how much money you would need to cover these (like a dental emergency, new fridge, etc.). It is impossible to prepare for every scenario. Still, there are good chances you will be ready for a lot of scenarios.

3. Come up with a plan for how to save up

You already have a list of your monthly expenses, so it is easy to check how much you could save every month. Be consistent and commit a fixed amount you can allocate to the rainy-day fund, and don’t stop until you reach your goal. Include it in your monthly budget.

4. Separate your rainy-day fund from your day-to-day account

Keep your rainy-day savings and everyday account separate. The best solution is to open a new savings account or if you already have one, dedicate a separate bucket for your rainy-day fund. This way, you can transfer your monthly savings each month, and you won’t be able to spend it accidentally. You can even set up recurring transfers to your rainy-day fund account, so you don’t have to think about it.

What if I need to use my rainy-day fund?

Your rainy-day fund should always be safe and accessible

Keep in mind that your rainy-day fund should be safe and easily accessible. It shouldn’t be invested in stocks or any other types of investments where there is a chance it could lose value over time or that you would not be able to access it quickly when you need it most. This is why it should be saved in a separate savings account dedicated to this one goal.

Only use your emergency savings in real emergencies

Once you reach your goal and save up enough for your rainy-day fund, you still have to be careful to assess which situations are emergencies. If you need to fix your broken car that you use for work every day, that qualifies as an emergency, but upgrading your phone to the newest model even though it is still completely functional might not be the best use for your rainy-day fund. A simple way to think about it is only to have your rainy-day funds as a last resort. Don’t pull from your rainy-day fund unless your only other option would be that you go into debt. If you do have to drain your rainy-day fund, as soon as your situation stabilizes, you should prioritize building it back up.

Rainy-day fund saved- what's next?

If you’ve reached your goal for your rainy-day fund, congratulations! It is a considerable achievement, and you should be proud of yourself! You have completed the first step towards financial independence. From this point forward, you can dedicate your savings to your other goals, whether that is your next big trip or saving up for a house.

Thinking about financial planning can be overwhelming, especially when thinking about potential hard times. It’s never easy to put your savings into your rainy-day fund instead of your next big trip or simply spending your money as it comes, but don’t forget that some planning ahead can save you from a lot of unnecessary stress later